Avalara, the tax management system in the United States integrated with your Odoo ERP

Who is Avalara?

Founded in 2004 and headquartered in Seattle, Avalara is an American company specialized in sales tax management and the automation of tax compliance, primarily through its Avatax platform.

Over the years, Avalara has experienced significant growth, establishing itself as a major player in the automated tax management sector on a global scale.

What are avalara products?

Avalara VAT Reporting, an integrated reporting solution

Directly integrated with your Odoo ERP, VAT Reporting is a tool that simplifies the production and submission of compliant VAT declarations. This streamlined approach to indirect tax reporting enhances operational efficiency while reducing the risks associated with non-compliance.

By leveraging data from your Odoo ERP system, the VAT Reporting solution automatically generates indirect tax declarations in accordance with local requirements. This automation aims to reduce the time required for the creation and filing of declarations while incorporating compliance verification mechanisms, thanks to the expertise of Avalara VAT Reporting.

Avalara VAT Reporting offers several advantages, including:

- Automated statutory declarations in over 40 countries

- Coverage of the 27 EU member states and beyond

- Multiple types of declarations: VAT, Intrastat, goods movements, VAT books, VAT SAF-T, local declarations

- Data optimization from external sources (VIES, BCE)

- Over 150 checks to identify indirect tax errors

- Automatic reconciliations with GL and Intrastat data

- Multilingual features and detailed content by country

Avalara VAT Reporting provides a comprehensive solution, suitable for Shared Service Centers (SSCs), allowing centralized management of the process regardless of your team's location.

Avalara VAT Registrations

Avalara's VAT declaration management service is designed for businesses looking to outsource the entire international VAT payment and declaration process. This includes VAT registration and declaration services within the European Union.

Avalara software provides a comprehensive solution by handling VAT registration on your behalf in foreign countries, collaborating with local tax authorities. Additionally, Avalara takes care of your VAT declarations, Intrastat reports, goods movement declarations, and other reporting requirements, saving you time and money.

This American tax management software supports multiple national languages and provides guidance on your reporting obligations in any country, while also liaising with local tax authorities on your behalf.

Avalara AvaTax for sales tax management

Avalara offers a cloud-based solution to assist businesses exporting to the United States in meeting their sales and tax obligations. This solution seamlessly integrates into ERP, POS, or e-commerce systems, automating real-time calculation of sales and use taxes.

Avalara AvaTax for Sales Tax solution provides a comprehensive approach to tax compliance, including:

- Over 500 pre-built integrations

- Audit protection

- Real-time tax rate calculation for over 70,000 taxing jurisdictions

Managing a single tax jurisdiction, Avatax enables you to achieve a high satisfaction rate of 98.5% among clients.

The Avatax module goes beyond mere tax calculation. It considers product taxability, sourcing rules, exemptions, and other parameters to determine the applicable Sales Tax. By utilizing addresses approved by the United States Postal Service, Avatax ensures accurate and constantly updated tax determination in the cloud.

Avalara E-Invoicing and Live Reporting

Avalara E-Invoicing and Live Reporting, a solution for international compliance in electronic invoicing and financial automation.

- Simple API integration: Enhance your existing systems with e-invoicing and real-time reporting capabilities in the countries of operation.

- Global deployment: Avoid purchasing, upgrading, and maintaining multiple regional tools by adopting a single solution adaptable to legislative changes.

- Streamlined compliance management: Adhere to global regulations in electronic invoicing and real-time reporting through a single integration.

- Efficient data exchange: Facilitate the exchange of invoicing and tax declaration data with partners through local platforms and international networks.

- Financial services optimization: Automate manual invoicing processes, accelerating your digital transformation and reducing operational costs.

- Guaranteed future compliance: Utilize customized workflows to track mandatory e-invoicing regulations and adapt constantly to legislative changes.

- Centralized strategy: Consolidate your efforts in centralized projects for more effective management of e-invoicing and real-time reporting.

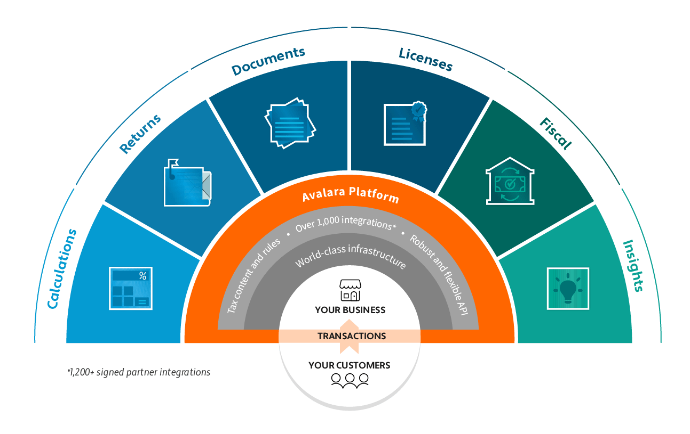

Main features of Avalara

Through automated tax filings, this American tax management software ensures VAT compliance. Its quick tax calculation capabilities on your sales streamline the taxation process.

Additionally, Avalara supports obligations related to electronic invoicing and electronic transmission of transaction data, ensuring smooth management of these aspects for your business. By providing a comprehensive solution, Avalara allows you to navigate through tax complexities while focusing your efforts on business development.

Boost your financial operations with Avatax in your Odoo ERP

The Avalara Avatax module is seamlessly integrated into your ERP as a standard feature. Its use in Odoo enables users to easily calculate sales tax for the United States and Canada. This integration simplifies the consolidation of financial data and tax compliance, eliminating manual data entry, reducing the risk of errors, and optimizing operational efficiency.

Transform your financial management with confidence by choosing Avatax in Odoo, an integrated solution to simplify and enhance your tax compliance.

Which ERP can i connect to avalara

Odoo ERP

Odoo is an open-source Enterprise Resource Planning (ERP) software that offers a comprehensive suite of business applications. These applications cover a wide range of business needs, including accounting, inventory management, sales, manufacturing, human resources, and more.

Odoo GOLD PARTNER

- Worldwide ERP solution

- Based Cloud ERP Solution or On Premise ERP Solution

- Prices per users

- Adapted for small businesses and mid-market businesses

- +40 000 apps availables on Odoo Marketplace